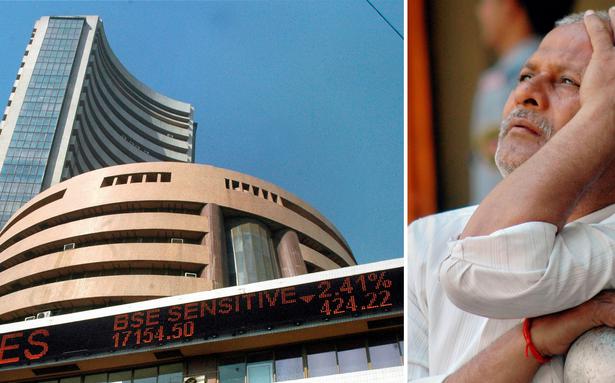

Unabated selling by overseas institutional investors weighed on the market, which fell on the 5th day.

Unabated selling by overseas institutional investors weighed on the market, which fell on the 5th day.

The benchmark indices continued their downward trend for the fifth trot session on Thursday, May 12, 2022, with the Sensex falling nearly 817 points in early trade, tracking weak global trends and on index majors Reliance Industries and HDFC Bank was sold off.

Unchecked selling by foreign institutional investors also weighed on sentiment.

The 30-part BSE Sensex was trading 816.78 points lower at 53,271.61. The NSE Nifty fell 234.05 points to 15,933.05.

Among the Sensex companies, major laggards included UltraTech Cement, Tata Steel, Bajaj Finance, M&M, IndusInd Bank, HDFC Bank, Bajaj Finserv and Larsen & Toubro.

In contrast, Power Grid emerged as the sole winner.

Elsewhere in Asia, Tokyo, Hong Kong and Seoul markets traded lower, while Shanghai traded marginally higher.

The stock exchanges in the US closed in the red on Wednesday.

“Asian equities fell on Thursday after elevated US inflation bolstered the case for aggressive monetary tightening and triggered a Wall Street slide,” said Deepak Jasani, head of retail research, HDFC Securities.

Meanwhile, international oil benchmark Brent fell 1.19 percent to $106.22 a barrel.

Overseas institutional investors continued their selling spree, selling Rs. 3,609.35 crore worth of shares on Wednesday, May 11, according to stock market data.

In previous trade, the BSE Sensex ended down 276.46 points, or 0.51 percent, at 54,088.39. The NSE Nifty fell 72.95 points, or 0.45 percent, to 16,167.10.

“Concern about rising interest rates”

“Indian markets are experiencing turbulent swings as investors remain concerned about rising interest rates, fears of slowing economic growth and additional tightening measures in China,” said Mohit Nigam, Head – PMS, Hem Securities.

VK Vijayakumar, chief investment strategist at Geojit Financial Services, said inflation continues to be a major headwind for markets.

“US consumer inflation of 8.3 percent in April is increasing market concerns about aggressive Fed rate hikes and the possibility of a US recession in 2023,” he added.

Even though domestic institutional investors (DII) are currently buying more than foreign institutional investors (FII) are selling, it’s not enough to lift market sentiment as macro headwinds are strong, Mr Vijayakumar said.