The finance minister assured that rising financing costs will not affect the government’s planned infrastructure investments

The finance minister assured that rising financing costs will not affect the government’s planned infrastructure investments

Finance Minister Nirmala Sitharaman said the Reserve Bank’s latest rate hike came as no surprise but was timely, and assured that rising borrowing costs would not affect the government’s planned infrastructure investments.

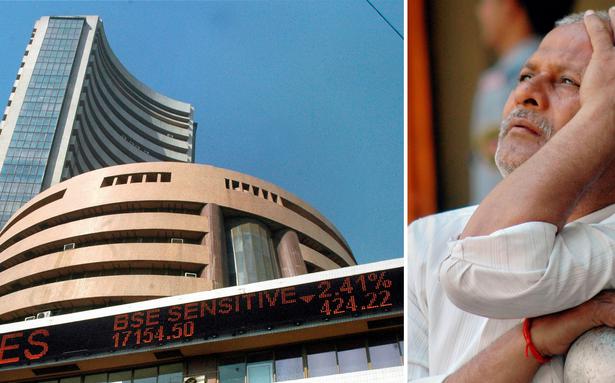

For the first time since August 2018, the RBI on May 4 presented an outright 40 basis point hike in the policy rate to 4.40% and also raised the cash reserve ratio by 50 basis points to 4.5% following an unscheduled rate-setting meeting, the panel pointed out the increased inflationary pressure after the Ukraine war and the resulting rise in crude oil prices.

Retail inflation was 6.9% in March and the April figure is expected to be above 7.7%.

“The timing of RBI’s rate hike came as a surprise, but not the action itself as people thought it should have been done anyway. It came as a surprise because it is between the two MPCs (Monetary Policy Committee) meetings. But the Federal Reserve has been saying it all along,” Ms. Sitharaman said in her first reaction to the rate hike, speaking at an awards ceremony organized by the Federal Reserve economic times on Saturday night in Mumbai.

She said the RBI hinted at the last MPC meeting that it was time for them to act as well and the hike is part of a synchronized action by major central banks around the world.

“In a way it was a synchronized action. Australia did it and the US did it that night. So today I see a greater understanding among central banks. But the understanding of how to deal with the recovery from the pandemic is not entirely unique or specific to India. It’s a global problem.”

“And even as we managed that recovery, inflation, which was smoldering at some incredible highs in, say, the US and UK, wasn’t so much smoldering in our country… Still, the challenge of the recovery versus inflation seems to be of a particular template follow that is now in place around the world,” she said.

However, she was quick to assert that the central bank’s decision would have no impact on the government’s planned tens of billions of dollars in infrastructure investments.

Speaking of economic sanctions against Russia after its invasion of Ukraine, she said the blockades are “constraining us” as traditional buyers from Russia switch to sources in India’s basket of crude oil, 80-85% of which is from the Middle East. This shift should put more pressure on the price of the Indian crude oil basket.

“The sanctions have caused people to rush to alternative sources where countries like us have been for decades. Now suddenly it will be full of people who want to buy the same thing. Therefore, supply and price factors will now have their impact on us,” she said, making it clear that India will continue to buy crude wherever it is available cheaply.

“Regarding our oil consumption and buying from the source that gives us a preferential price, we have asserted our right to do so. We’ve stated that we’ll certainly buy it, so it’s something that hasn’t been said for the first time. We continue with what is good for us. We need cheap fuel. If it’s available, why don’t we want to buy it?” she said.

Ms. Sitharaman said fertilizer prices had risen even before the war. The government had to seek additional spending approvals during the supplemental calls as crude oil surged and commodity prices rose due to supply disruptions.