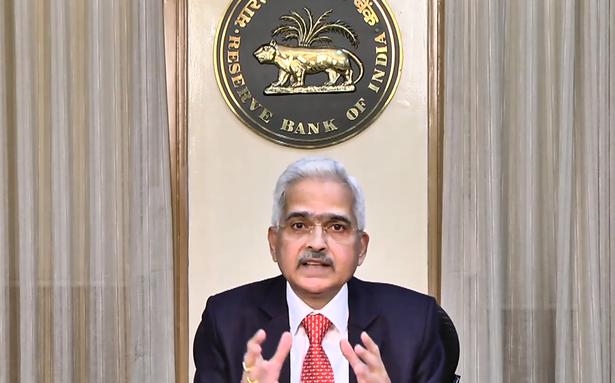

The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) unanimously voted to keep interest rates unchanged at 4% on April 8 based on an assessment of the macroeconomic situation and outlook.

“The MPC has also unanimously decided to remain accommodative while focusing on withdrawing accommodation to ensure future inflation remains on target while supporting growth,” RBI Governor Shakktanta Das said in the announcement .

The Marginal Standing Facility (MSF) rate and bank rate remain unchanged at 4.25%.

In addition, the Reserve Bank has decided to restore the width of the liquidity adjustment facility (LAF) corridor to 50 basis points, the position that prevailed before the pandemic.

“The bottom of the corridor is now provided by the newly launched standing deposit facility (SDF), which is placed 25 basis points below the repo rate, ie at 3.75%,” he said.

Explaining the MPC’s rationale for its interest rate decision and stance, he said the expected positive benefits from the waning Omicron wave have been offset by the sharp escalation in geopolitical tensions.

“This has significantly changed the outer and inner landscape. Concerns over protracted supply disruptions have rocked global commodity and financial markets given the significant share of the two economies locked in war in the world’s production and export of key commodities such as oil and natural gas; wheat and corn; palladium, aluminum and nickel; edible oils; and fertilizer. Global crude oil prices briefly topped $130 a barrel, hitting their highest level since 2008 and remain volatile at high levels despite some corrections,” he added.

“Global food prices have also increased significantly along with metal and other commodity prices. Risk aversion to emerging market assets (EMEs) has increased, leading to large capital outflows and a trend towards devaluation of their currencies. First, these developments have pushed up forecasts for global inflation, which was already well above target in major countries; and second, it will have a significant adverse impact on production in all regions,” he said.

Stressing that geopolitical tensions have intensified at a time when the global economy has been grappling with a sharp rise in inflation and the consequent normalization of monetary policy in the major advanced economies, he said the disruptions to global supply chains and the Pressure on input costs is now likely to continue for some time.

“The resurgence of COVID-19 infections in some major economies in March and the associated lockdowns risk exacerbating global supply shortages and input cost pressures. World trade and production and thus foreign demand are likely to be weaker than forecast two months ago,” he said.

Overall, external developments over the past two months have meant downside risks to the domestic growth outlook and upside risks to the inflation forecasts presented in the February MPC resolution have materialized, he noted.

Inflation is now expected to be higher and growth lower than the February estimate. Economic activity, while recovering, is barely above pre-pandemic levels, he added.

The governor said as the horizon cleared, escalating geopolitical tensions cast a shadow over our economic outlook.

Under these circumstances, real GDP growth for 2022-23 is now forecast at 7.2%, Q1:2022-23 at 16.2%; Q2 at 6.2%; Q3 at 4.1%; and Q4 at 4.0%, assuming crude oil (Indian basket) at $100 a barrel in 2022-23, Mr Das said.

Similarly, inflation is now forecast at 5.7% for 2022-23, with Q1 at 6.3%; Q2 at 5.8%; Q3 at 5.4%; and Q4 at 5.1%.

In his opening remarks, he noted: “We are facing new but daunting challenges – shortages of key raw materials; breaks in the international financial architecture; and fears of deglobalization. Extreme volatility characterizes commodity and financial markets.”

“While the pandemic has rapidly evolved from a health crisis to a life and limb crisis, the conflict in Europe has the potential to derail the global economy. Faced with multiple headwinds, our approach must be cautious but proactive to mitigate the adverse impact on India’s growth, inflation and financial conditions,” he added.

“However, we are reassured by the strong buffers we have built up over the past few years, including large foreign exchange reserves, a significant improvement in external sector indicators and a significant strengthening of the financial sector, which would all help us weather this storm. Once again we at RBI stand resolute and ready to defend the economy and steer out of the current storm,” he added.