The size of the IPO was reduced from a previously planned ₹7,460 billion to ₹5,235 billion

The size of the IPO was reduced from a previously planned ₹7,460 billion to ₹5,235 billion

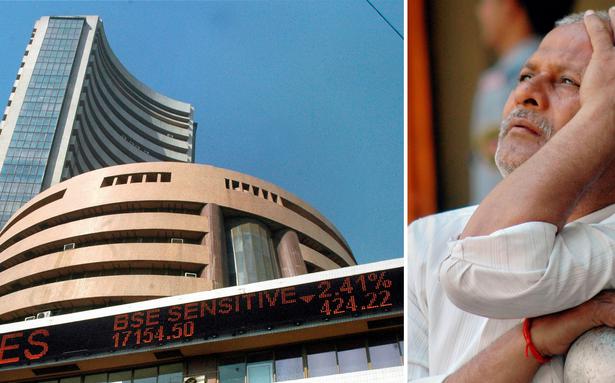

Supply chain company Delhivery raised £2,347 billion from anchor investors on May 10 ahead of its first share sale, which opened for public subscription on May 11. The company has decided to allocate a total of 4,81,87,860 shares to anchor investors at ₹487 a share, which is also the upper end of the price range and aggregates the deal size to ₹2,346.74 crore, according to a circular uploaded to the BSE website.

AIA Singapore, Amansa Holdings, Aberdeen New India Investment Trust Plc, Goldman Sachs, The Master Trust Bank of Japan, Government of Singapore, Monetary Authority of Singapore, Fidelity, Tiger Global Investments Fund, Steadview Capital Master Fund, Morgan Stanley Asia (Singapore) Pte, Societe Generale and Segantii India Mauritius are among the anchor investors.

In addition, SBI Mutual Fund (MF), HDFC MF, ICICI Prudential MF, Mirae MF, ICICI Prudential MF, Invesco MF and Nippon India also participated in the anchor round.

The size of the initial public offering (IPO) was reduced from previously planned ₹7,460 billion to ₹5,235 billion.

The public offering now includes a new issuance of shares worth ₹4,000 crore and an offering to sell (OFS) component of ₹1,235 crore by existing shareholders.

As part of the OFS, investors Carlyle Group and SoftBank and the co-founders of Delhivery will divest their stake in the logistics company.

CA Swift Investments, a Carlyle Group company, will sell ₹454 crore of shares, SVF Doorbell (Cayman) Ltd, a division of Softbank Group, will sell ₹365 crore of shares, Deli CMF Pte Ltd, a fully Affiliate of private equity fund China Momentum Fund, LP will sell ₹200 crore of shares and Times Internet will sell ₹165 crore of shares.

In addition, Delhivery co-founders – Kapil Bharati, Mohit Tandon and Suraj Saharan – will sell shares worth ₹5 crore, ₹40 crore and ₹6 crore respectively.

Currently, SoftBank owns 22.78%, Carlyle 7.42%, Bharti 1.11%, Tondon 1.88% and Saharan 1.79% of the company.

The public offering, with a price range of ₹462 to ₹487 per share, opened for subscription on May 11 and will close on May 13.

Proceeds from the reissuance will be used to fund organic growth initiatives, fund inorganic growth through acquisitions and other strategic initiatives, and for general corporate purposes. A total of 75% of the issue is reserved for qualified institutional investors, 15% for non-institutional investors and the remaining 10% for retail investors.

In addition, the Company has reserved shares worth ₹20 crore for eligible employees who will receive a discount of ₹25 per stock share during the bidding process.

Investors can bid for a minimum of 30 shares and multiples thereof.

From logistics to value-added services

Delhivery provides a full range of logistics services including express parcel delivery, heavy lift delivery, warehousing, supply chain solutions, cross-border express and freight services and supply chain software, as well as value-added services such as e-commerce return services, collections and processing, installation and assembly.

The e-commerce logistics company operates a pan-India network and offers services in 17,045 postal code (PIN) codes. The company’s express parcel delivery network, which served 17,488 PIN codes in the nine months ended December 2021, covered 90.61% of the 19,300 PIN codes in India. The company provides supply chain solutions to a diverse base of 23,113 active customers such as e-commerce marketplaces, direct-to-consumer e-tailers, as well as enterprises and SMBs across multiple industries including FMCG, durable consumer goods, consumer electronics, lifestyle and retail, Automotive and Manufacturing. The Gurugram-based company said about five customers contributed to more than 40% of its sales in FY21.

Kotak Mahindra Capital Company, BofA Securities India, Morgan Stanley India Company and Citigroup Global Markets India are the lead bookers of the offering. The supply chain company’s shares will be listed on the stock exchanges – BSE and NSE – on May 24.

In August, Delhivery acquired Spoton to further expand its part truck (PTL) freight service business.