Central bank holds interest rates and lowers growth estimate as shadow of war clouds India’s outlook

Central bank holds interest rates and lowers growth estimate as shadow of war clouds India’s outlook

The Reserve Bank of India’s Monetary Policy Committee on Friday raised its estimate for FY23 inflation to 5.7%, from the 4.5% forecast in February before Russia invaded Ukraine, stressing that it is improving will now focus on “retreating adjustments to ensure that inflation remains on target going forward”.

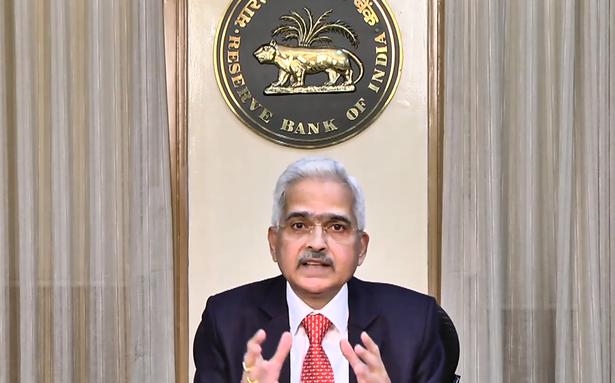

“In order of priority, we have now put inflation ahead of growth,” RBI Governor Shakkanta Das said at a news conference after announcing the MPC’s decision to keep rates on hold at its first monetary policy review of the new fiscal year. “In the last three years, growth has outpaced inflation. This time we reversed it because we thought the time was appropriate,” he added.

Similarly, the RBI has begun withdrawing some of the housing provided over the past two years as it moves towards normality, albeit gradually.

“The attitude is still accommodative, but we are now focused on withdrawing accommodation. So we are gradually moving away from an ‘accommodative’ attitude that has existed for more than two years,” Mr Das said.

The central bank had switched from a “neutral” to an “accommodative” stance in mid-2019.

Explaining the change in course, RBI Deputy Governor Michael Debabrata Patra said: “We have taken the policy repo rate to an all-time low of 4%. If you adjust it with target inflation, the real interest rate is zero. This was ultra accommodation. The situation is changing and now we want to withdraw the Ultra property, but there is scope to remain accommodating.”

Mr Das explained that the MPC decided to revise inflation forecasts for FY23 upwards, with Q1 estimate at 6.3%; Q2 at 5.8%; Q3 at 5.4%; and Q4 at 5.1% due to “war related factors”.

Mr Das cited the sharp rise in crude oil, cooking oil and wheat prices, as well as feed costs – which have pushed up poultry, egg and dairy prices – as the reason for the higher estimates.

Earlier in the day, the MPC voted unanimously to keep interest rates unchanged at 4% based on an assessment of the macroeconomic situation and outlook.

In his statement, Mr Das said even as the horizon was clearing, escalating geopolitical tensions had cast a shadow over India’s economic prospects.

As a result, real GDP growth for FY23 was forecast lower at 7.2% compared to the previously estimated 7.8%. RBI quarterly guidance is: Q1 at 16.2%; Q2 at 6.2%; Q3 at 4.1%; and Q4 at 4%, assuming crude oil (Indian basket) averages $100 per barrel in FY23.

“Given the excessive volatility in global crude oil prices since late February and the extreme uncertainty surrounding evolving geopolitical tensions, any growth and inflation forecast carries risks and is largely dependent on future oil and commodity price developments,” noted Mr Das.

“The Reserve Bank will use all its policy levers to maintain microeconomic stability and build the resilience of our economy,” he said.

“The situation is dynamic and changing rapidly and our actions must be tailored to this,” he added.

Asked about the likely impact of economic fallout due to ongoing trade between India and Russia, which is facing sanctions from Western nations following its invasion of Ukraine, Mr Das said: “The government is dealing with the issue and will deal with it. As for RBI, we will not take any action that violates the sanctions.”

“The war disrupted trade payments,” Deputy Governor T. Rabi Sankar noted. “We discuss with all stakeholders and are sensitive to sanctions,” he added.

“While the pandemic has rapidly evolved from a health crisis to a life and livable crisis, the conflict in Europe has the potential to derail the global economy,” Mr. Das noted earlier in his statement. “Faced with multiple headwinds, our approach must be cautious but proactive to mitigate the adverse impact on India’s growth, inflation and financial conditions,” he added.

“However, we are reassured by the strong buffers we have built up over the past few years, including large foreign exchange reserves, a significant improvement in external sector indicators and a significant strengthening of the financial sector, which would all help us weather this storm. Once again, we in the RBI stand resolute and ready to defend the economy and steer it out of the current storm,” said the central bank governor.