Finance Minister Nirmala Sitharaman on Saturday called anonymity an “inherent risk” of blockchain technology and called for future precautions as the technology grows.

The minister made it clear that the use of distributed ledger technology (DLT), also known as blockchain, is “absolutely mandatory” and that the government supports the use of the same.

Her comments come ahead of the unveiling of the budget announcement of the Central Bank’s digital currency (CBDC), which is based on blockchain technology and is billed as being similar to the fiat currency carried in our wallets.

“The anonymity is … an unknown element in this whole thing. The anonymity of the person or whoever or the robot is what we absolutely must prepare for [for] as … a future challenge,” Ms. Sitharaman said, addressing an NSDL event here.

She said DLT is a “beautiful” technology that would help democratization, but called anonymity an “inherent risk” that “we must guard against.”

Calling anonymity a “strong unpredictability” in the whole equation, Ms Sitharaman said: “If we can’t protect ourselves from this anonymous element, which itself can pose an inherent risk, we’re likely to be exposed to a lot more than we ever have imagined.” “

She commended Madhabi Puri Buch, head of capital markets regulator SEBI, who spoke before her at the same event, for “rightly warning us about the risk of anonymity” and also speaking out in favor of DLTs.

Ms Buch said authorities did not want anonymity in the CBDC, which is due to be introduced by banking regulator RBI this fiscal year.

According to the central bank, significant progress has been made towards the introduction of the CBDC.

Ms. Buch said the strengths of DLTs include transparency, real-time information, infinite shareability and the fact that it’s a low-cost medium.

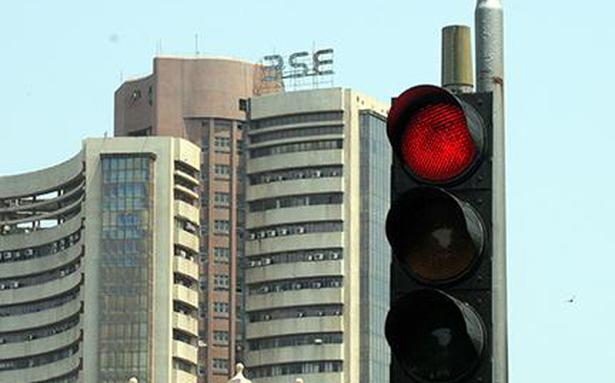

Ms Sitharaman said the path of retail investment has changed over the past two or three years, with new Demat accounts opening going from 12 lakh in FY21 to 26 lakh a month in FY22 and just 4 lakh a month in FY20 increased.

She said retail investors act as “shock absorbers” as foreign portfolio investors enter and exit the market, according to global cues.

Noting the $4 trillion total value held by NSDL, Ms. Sitharaman said the boost in retail account openings was a key reason for the high asset value.

A stamp and envelope commemorating the NSDL’s 25 year journey was also unveiled at the event. The Depositary also launched a program aimed at educating college students about capital markets.