India records its highest direct net tax revenue at ₹14.09 lakh crore in FY22; Figures outperform indirect tax figures

India records its highest direct net tax revenue at ₹14.09 lakh crore in FY22; Figures outperform indirect tax figures

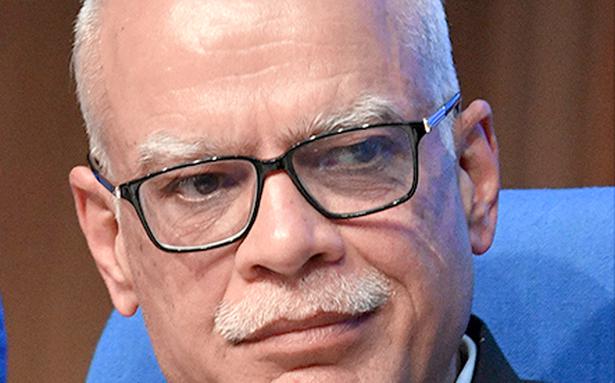

India’s direct tax net receipts for FY22 were £14.09.640.83 billion, the highest ever tally, suggesting the Indian economy has bounced back after two years of the pandemic, JB Mohapatra said , Chairman of the Central Board of Direct Taxes (CBDT). on Tuesday.

“Compared to 14.09 lakh crore this year, our 2020-21 collection was just 9.45 lakh crore. In a single year we are up nearly ₹4.5 lakhcrore and have grown 49.02%,” he told a news conference.

“The levy of ₹14.09 lakh crore is the best levy ever in terms of income and corporate tax. Before that, the department only reached a figure of 11.44 lakh crore in 2018-19.

Gross direct tax revenue (before accounting for refunds) for FY22 was ₹16,34,454.95 billion compared to ₹12,31,270.52 billion in FY21, an increase of 32.8%.

“The increase in net and gross collection figures is an important indication of the strengthening of the Indian economy. This is the clearest signal that the Indian economy has recovered after two years of the pandemic,” Mr Mohapatra said.

“At this point, the ratio of direct taxes to GDP is around 12%,” he added, adding that the department is working to raise the ratio to 15-20% in 5-10 years. “Direct tax collection this year has surpassed indirect tax collection, which was reversed until last year. Now it’s 52%… Our goal is to have 60% of the tax contribution from direct taxes in a few years,” said the CBDT Chair.

“Besides the factor of strengthening the Indian economy, the increase in tax collection is attributed to the number of reforms initiated by the Indian government. In the past five to six years, reforms within the department and reforms outside the department have done a great deal to keep the economy together,” he said.

The CBDT Chairman stated that “our technological implementation has improved the department’s functioning and information collection system. All financial transactions from different sources and from different entities are collated. It allows taxpayers to see their own transactions in no time. Annual information system (phase I and II) records various financial transactions. They are not only assembled, but also sent back. This has a positive effect on our collection numbers.”

“We are taking steps to expand the taxpayer base. We also want taxpayers to migrate from taxable entities in the lower quadrant to higher ones,” Mr Mohapatra said.

According to the CBDT, more than 7.14 million income tax returns (ITRs) for the 2021-22 tax year were filed on the new e-filing portal compared to 6.97 million ITRs filed for the 2020-21 AY, an increase of 2.4%.