If crude oil prices remain at higher levels, it will likely affect India’s current account deficit as well as the budget deficit as the country imports more than 80% of its total needs, an analyst says

If crude oil prices remain at higher levels, it will likely affect India’s current account deficit as well as the budget deficit as the country imports more than 80% of its total needs, an analyst says

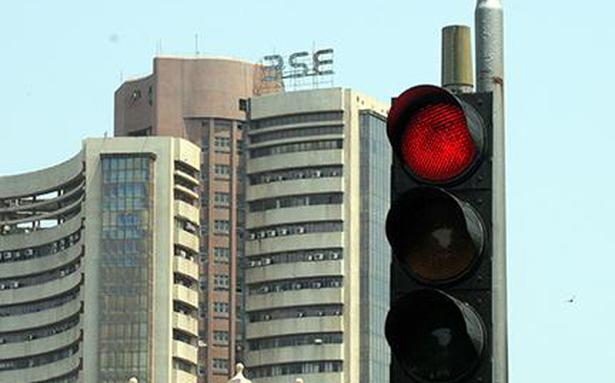

Major stock indexes fell sharply on Monday, following global cues in the wake of Russia’s war against Ukraine and a rapid rise in crude oil prices that has sent shockwaves around the world.

The S&P BSE Sensex fell 1,491.06 points, or 2.74%, to 52,842.75 on Monday.

The decline was led by banking and financial stocks, and among the biggest losers were IndusInd Bank, down 7.63%, Axis Bank (-6.7%), Maruti Suzuki (-6.56%), Bajaj Finance ( -6.37%) and Bajaj Finserv (-6.27). %).

Sector indices were mixed, with Telecom, IT, Metals and Oil & Gas ending in gains while Auto, Banks and Capital Goods were among the biggest losers.

The NSE Nifty 50 index broke the psychological 16,000 mark; fell 382.20 points, or 2.35%, to 15,863.15.

“Oil prices surged above $130 a barrel for the first time since July 2008 amid the risk of a US and European ban on Russian oil exports, which account for about 10% of global supply,” said Vinod Nair, research director at Geojit financial services.

“As a result, the domestic market, along with its global competitors, experienced a huge sell-off from opening hours. Inflationary pressures can also be seen in other commodities such as gold, aluminum and copper, which will eventually eat up corporate earnings in the coming quarters,” he added.

Pankaj Pandey, Head – Research, ICICIdirect said: “If crude oil prices remain at higher levels, this will likely affect India’s current account deficit as well as the budget deficit as India imports more than 80% of its total needs.”

“Regarding the stock market outlook, we believe volatility will persist in the short-term until there is clarity on the cessation of this attack. In the near term, metals, IT and pharmaceuticals would be the key resilient sectors,” he added.