Finance Minister Nirmala Sitharaman acknowledged concerns that the return on the Employees’ Provident Fund (EPF) would fall to a more than four-decade low 8.1% in 2021-22, stressing that the decision was based on the “Today’s realities” and the returns on other savings vehicles were even lower.

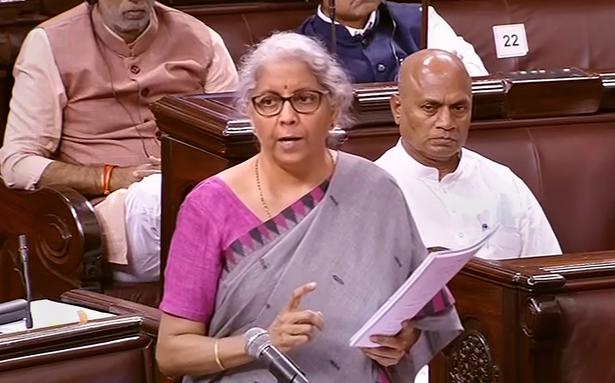

Responding to Rajya Sabha MPs who denounced the reduction in the EPF rate from 8.5% to 8.1%, Ms Sitharaman said she appreciated and acknowledged her position on the decision, stressing that it came from the central board of trustees approved by the EPF organization, which includes representatives from workers, management and government.

“The Sukanya Samriddhi Yojana [rate] is 7.6%, Senior Savings Scheme is 7.4%, PPF (Public Provident Fund) is 7.1%, State Bank of India top rate for 5-10 year term deposits is 5, 5% and has a seniors markup that brings it to 6.3%,” the FM said. “Government debt is 6.28% on average across different maturities. In light of all this, the EPFO has taken a call to keep it at 8.1%,” the minister said.

“It has yet to be approved by the Treasury, but the fact remains that these are the prevailing rates today and are still higher than the others (instruments),” Ms Sitharaman said in response to the Appropriation Bill debate in the Upper House of Parliament.